Table of Contents

Nagomi simplifies M&A cybersecurity by unifying asset inventories, security tools, and policies across merging companies. It accelerates cyber due diligence, exposes hidden vulnerabilities and duplicate spend, and makes post-merger security integration faster and safer. Organizations gain full visibility, reduce risk exposure, control licensing costs, and keep deals on track without disruption.

Mergers and acquisitions sound bold and exciting. For security teams, they’re usually chaos in a suit: two companies, overlapping tools, unknown assets, and an aggressive close date. As Global M&A topped $2.5 trillion in 2023, yet fewer than 1 in 10 companies complete proper M&A cybersecurity due diligence before signing. That gap leads to hidden exposure, wasted spend, and dangerous blind spots that can derail post-merger security integration. It makes sense why attackers love this moment of distraction.

Nagomi changes the game. It gives security teams the clarity and control to integrate safely, avoid delays, and protect deal value.

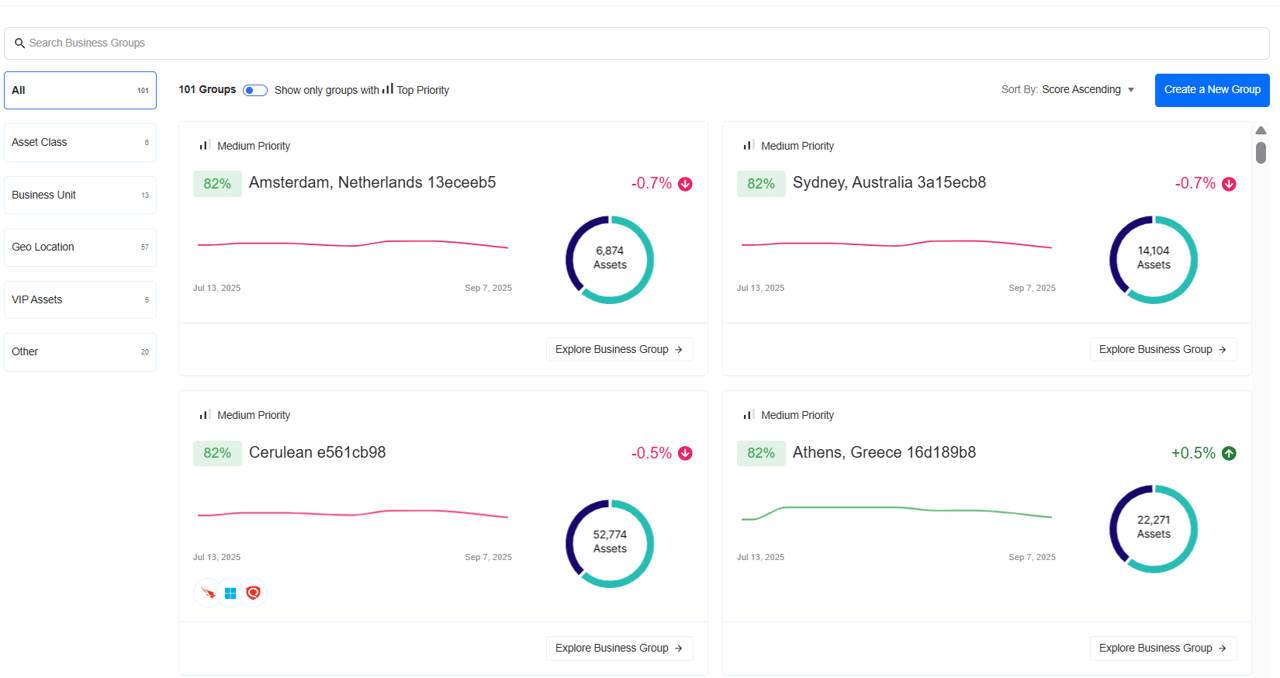

One Unified Security Picture

The first step in any merger is figuring out what you have. Without a unified view, each team works from its own spreadsheets and assumptions, a recipe for missed assets and blind spots.

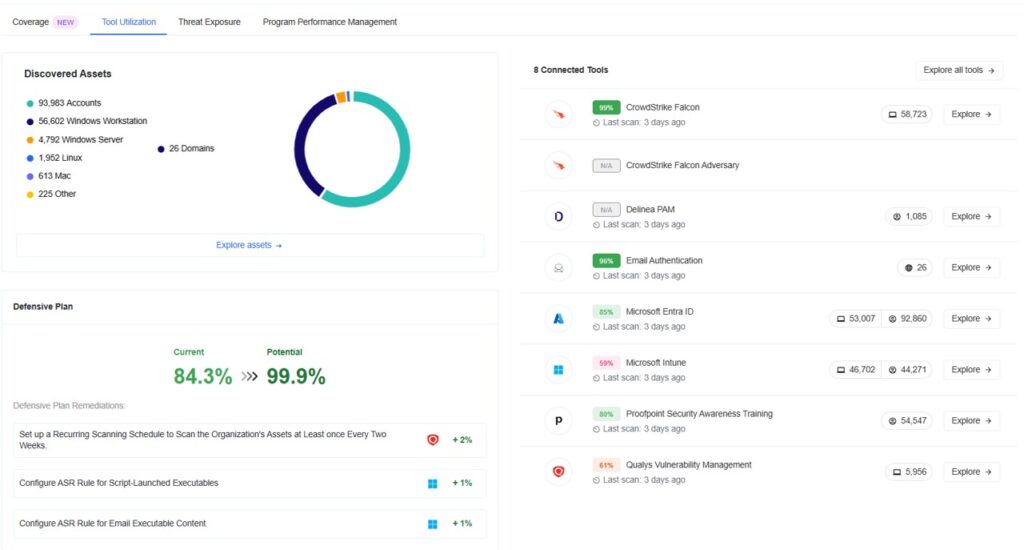

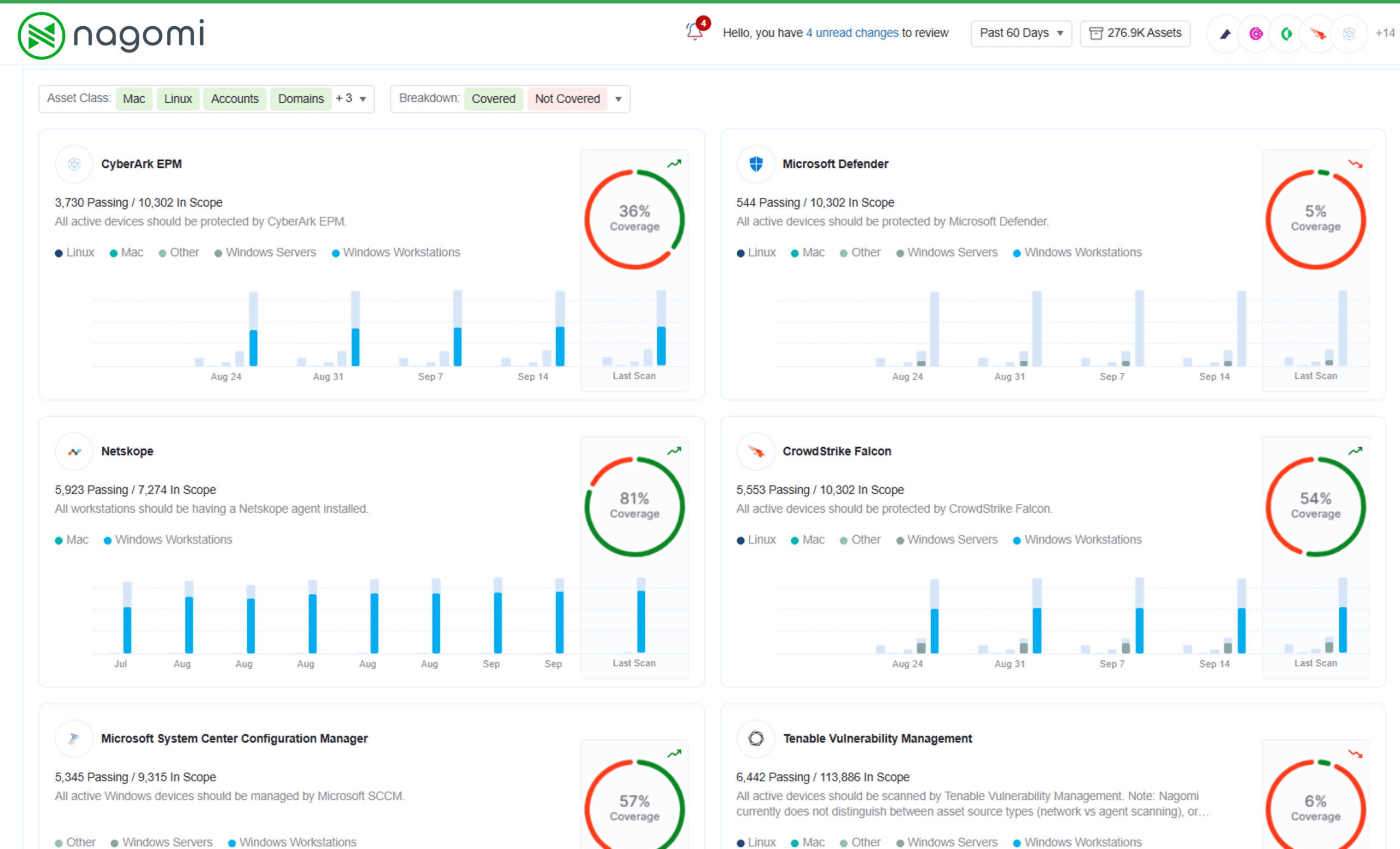

Nagomi integrates all your security tools into one platform, creating a single source of truth. You can see every tool, every asset, and every policy in one place. This makes it easy to compare performance across both companies and apply consistent best-practice policies. Maybe one company is great at vulnerability management while the other excels at endpoint security. Nagomi helps you see these strengths clearly, so you can raise the bar across the board.

Automatic Coverage and Gap Mapping

In a merger, coverage questions come fast:

- Which assets are protected?

- Where are the gaps?

- Where are you paying twice for the same functionality?

Nagomi maps coverage automatically. You’ll see exactly which tools protect which assets, identify gaps where critical systems are unprotected, and pinpoint overlapping tools to consolidate. This insight helps reduce risk and optimize spend especially critical when non-malicious missteps are responsible for most M&A security incidents.

Manage Duplicate Platforms Without Losing Track

Mergers often involve duplicate tools: two vulnerability scanners, two EDRs, two SIEMs. Without clear separation, teams can lose track of which system is reporting what.

Nagomi supports multiple integrations of the same tool, so you can bring both instances in, label them clearly, and view data together or separately. This prevents confusion and ensures you’re comparing apples to apples.

Integrate at Your Own Pace

Mergers rarely happen overnight. Sometimes you need to keep systems separate for a while before full integration.

Nagomi makes this easy with a parent-child tenant architecture. Each company’s tools and reports remain separate but visible under a shared umbrella. You maintain control, avoid premature consolidation, and merge when the timing is right, without losing visibility in the meantime.

Real World Proof

One of our customers acquired a smaller firm whose security environment was a tangle of outdated tools and missing inventories. Within days of integrating both environments into Nagomi, they:

- Discovered multiple coverage gaps before the deal closed

- Standardized policies to the stronger baseline across both companies

- Identified redundant tools and saved on licensing costs

- Avoided a compliance issue that could have delayed integration by weeks

This level of clarity not only protected the deal’s value, it gave the team breathing room to plan their long-term strategy.

What Comes Next

M&A is about more than finance and culture. It’s about building a unified organization that can grow without hidden risks lurking beneath the surface.

Nagomi gives you the visibility and control to get there. By turning fragmented data into a clear picture, it helps teams make smart, confident decisions during one of the most challenging transitions a business can face.

When security is a strength, it doesn’t just protect the deal, it accelerates it.

If you want to see what execution looks like in practice, we’d be glad to show you.

Ready to see exposure through a new lens and finally shrink it? [Let’s talk.]