back to blog

BLOG

Attackers Aren’t Bypassing Financial Services Defenses. They’re Exploiting What’s Overlooked

Cyberattacks against financial service institutions (FSI’s) aren’t just rising; they’re feeding on complexity. The average cost of a data breach in this sector was nearly $6 million last year — second only to healthcare, and 65% of financial institutions experienced ransomware attacks in 2023, almost double the rate just two years prior. Threat actors aren’t going after what’s obvious anymore. They’re exploiting what’s overlooked: misconfigured tools, unaddressed gaps in sprawling IT estates, and the kind of buried risk that builds up over time as cybersecurity debt – a challenge that’s especially prevalent in financial services due to years of rapid growth, legacy systems, and complex regulatory requirements.

At the same time, regulators are done waiting for the industry to catch up. New mandates like DORA, updated FFIEC guidelines, and SEC rules are no longer about planning, they’re about proof. You don’t just need controls in place. You need to show how well they work, what they’re missing, and what you’re doing about it.

Here’s the uncomfortable reality: Most teams can’t answer those questions. They’ve invested millions into tools and still can’t tell what’s covered, what’s at risk, or what’s noise.

Nagomi Gives Financial Institutions Real-Time, Audit-Ready Answers

Nagomi delivers the connected visibility financial institutions need, not just more alerts, but clear insight into whether your existing tools are actually doing their job across every region, subsidiary, and technology stack.

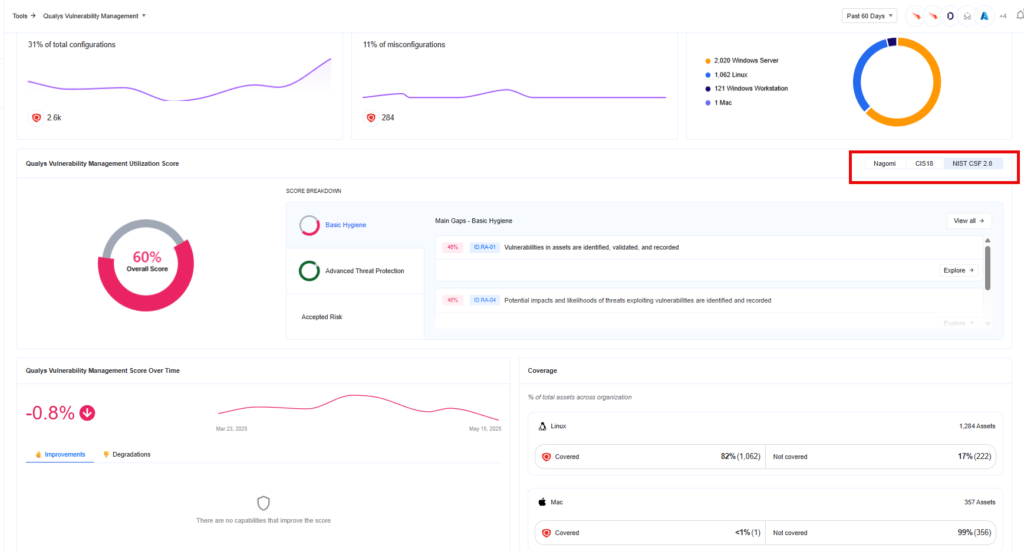

By mapping assets, controls, and exposures to major frameworks like NIST, MITRE ATT&CK, and CIS, Nagomi transforms raw data into actionable, trustworthy evidence:

- For regulators — to show compliance on demand

- For auditors — to validate control effectiveness and coverage

- For boards — to guide risk-informed, strategic decisions

Unified Visibility That Powers Everything Else

Visibility is foundational not just for security teams, but for compliance, board-level reporting, and operational resilience. Yet most financial environments are fractured across legacy systems, cloud workloads, third-party platforms, and distributed business units. Every disconnected tool and unmanaged integration contributes to cybersecurity debt, making it harder to see what’s protected, what’s exposed, and what’s been forgotten.

Nagomi integrates with existing security tools to consolidate data from across all parts of the infrastructure. By normalizing and contextualizing data from endpoints, network controls, vulnerabilities, and threat intelligence sources, the platform provides a single, correlated view of risk. This centralized visibility reduces silos and improves decision-making by allowing teams to assess their exposure continuously and comprehensively.

Every Control Tells a Story. Most Are Wrong.

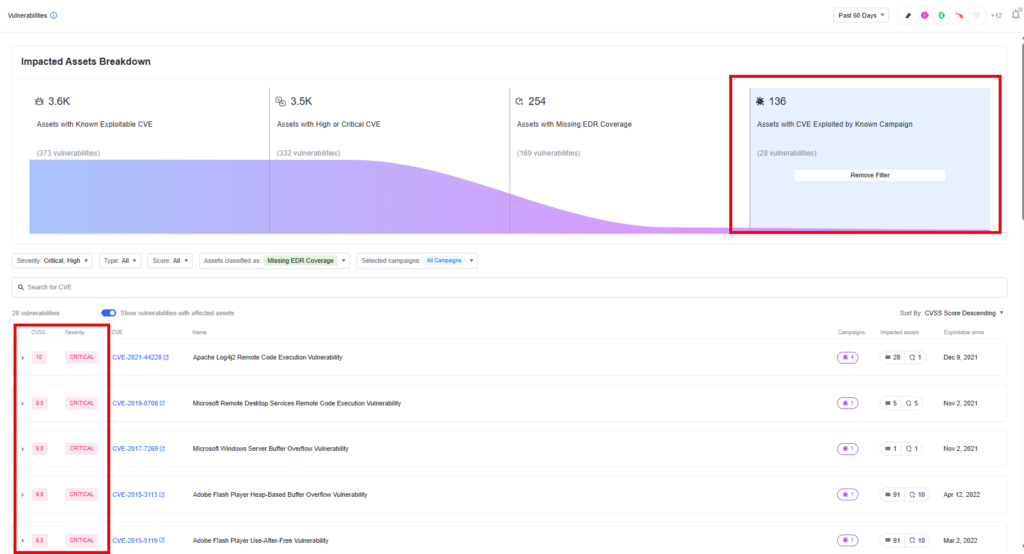

Between vulnerability scanners, penetration tests, threat intel feeds, and compliance checks, the list of “issues” grows by the hour. But most of those issues won’t lead to a breach.

The problem isn’t only finding vulnerabilities. It’s knowing which ones could actually shut down trading, expose customer data, or trigger a regulatory nightmare. Nagomi doesn’t just give you another list, it hunts the blind spots you’re betting no one will find. It pulls from the data you already have: your controls, your asset inventory, your threat intelligence. Then it overlays that with real-world exploitability and business context; what’s critical to operations, what’s exposed, and what your defenses would actually stop.

The result? You stop wasting time on theoretical risk and focus on what could actually take you down.

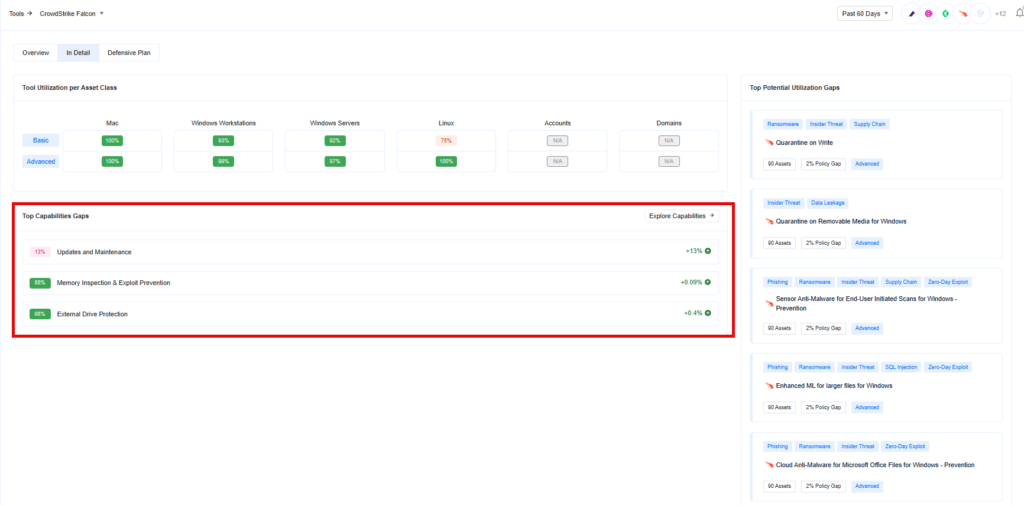

And here’s the part most teams miss: even if you patch the right things, it doesn’t mean your controls would stop an attacker. Can they escalate privileges? Move laterally? Access sensitive data? Nagomi’s Proactive Defense Platform doesn’t assume your controls will work — it stress-tests every promise your stack makes.

Compliance & Reporting: Automating Accountability at Scale

Financial institutions now have to navigate a labyrinth of local, regional, and global regulations — from DORA and FFIEC updates to SEC and GDPR compliance — each with different reporting standards, timelines, and data requirements. Not to mention, a staggering 73% of financial institutions report that data fragmentation is a major barrier to meeting compliance demands. Even further? This is compounded by a surge in remote work, third-party vendors, and cloud-based services, creating a sprawling infrastructure that’s difficult to track, monitor, and report on.

In this environment, financial institutions are not just burdened with reporting obligations; they’re at risk of falling behind, exposing themselves to fines, breaches, and irreparable reputational damage if they can’t keep up with real-time compliance requirements.

Nagomi dismantles the silos attackers count on. It integrates with existing tools and provides real-time visibility into every aspect of your security posture. With continuous tracking of control performance, Nagomi ensures that you can prove compliance whenever required, without scrambling to pull data together manually. Its automated platform can generate audit-ready reports in real time; reports that reflect your security performance, vulnerabilities, and threats as they evolve. When a regulator shows up, Nagomi gives you the proof they’re looking for — instantly.

Strengthening What’s Vulnerable, Not Just What’s Visible

Attackers are no longer bypassing sophisticated defenses; they’re exploiting the assumptions we’ve made about what’s secure, what’s tested, and what’s truly covered. This isn’t speculation; it’s the new reality of modern cybersecurity in finance.

This is where financial institutions are falling behind, and where they need to focus now more than ever. As regulatory frameworks like DORA and FFIEC demand concrete proof of operational resilience, it’s no longer acceptable to rely on assumptions or outdated testing practices. Financial organizations must continuously prove that their defenses are functional, their response plans are effective, and their resilience is ready for the real-world scenarios attackers are actively probing for.

Where others see risk, Nagomi sees opportunity. It’s not about keeping attackers out; it’s about knowing where vulnerabilities are hiding and proactively closing those gaps before they’re exploited. The platform continuously tests your security controls against the tactics, techniques, and procedures (TTPs) that real-world attackers use. By doing so, it exposes flaws that would otherwise remain hidden in the complexity of sprawling IT environments. This allows your teams to prioritize what really matters: mitigating threats that could have the highest impact, not just the loudest alerts.

The question is no longer “are we secure?” It’s “how do we prove it when the regulators come knocking—and how fast can we act when an attack hits?”

Once prioritized, these insights become even more valuable when applied to real-world readiness not just risk tracking, but response capability.

Proactive Defense Creates Greater Operational Efficiency

Financial institutions aren’t just defending against more threats; they’re navigating a regulatory and operational maze that’s accelerating by the day. It’s not just the rise in ransomware or the cost of breaches. What’s changed is the constant demand for real-time proof, across every region, system, and business unit.

Regulations like DORA, FFIEC, GLBA, and SEC breach reporting rules no longer ask whether you have controls in place. They ask: Are they working right now? Can you prove it instantly? Can you act even faster?

In a sector defined by hybrid work, third-party dependencies, evolving threats, and relentless audits, that’s a tall order and it’s not slowing down.

That’s where operational efficiency becomes your competitive edge. Nagomi is built not just to improve visibility but to operationalize how you secure, measure, and manage your environment -continuously.

Want to Know More?

Schedule a demo and learn how Nagomi can help your organization navigate today’s complex financial threat landscape with greater clarity, efficiency, and confidence.